The pandemic has shown stronger value in extended stay business, with the co-living model in particular attracting investors big and small. Raini Hamdi finds out how sustainable this trend is in Asia

The co-living model is an investor magnet and the space is getting crowded in Asia, especially in saturated hotel markets such as Singapore.

Already, consolidation is happening, as seen in the share swap merger between Singapore’s Hmlet and European co-living player Habyt in April. A month earlier, another co-living player, Singapore’s Assembly Place, share-swapped with Libeto, which operates Commontown.

Hmlet’s consolidation, however, is widely attributed to brazen growth by the start-up, which started with strata units in 2016 and grew to 1,500 units in Singapore, Hong Kong, Australia and Japan. In May, Hmlet’s troubles came to light when Australian media reported its exit from the market with unpaid debts amounting to more than A$500,000 (US$350,670).

On the other hand, the Assembly Place/Commontown merger shows that increasingly, scale is needed in the co-living segment as more competitors enter the market. It gives Assembly Place a portfolio of 600 units, including 120 rebranded Commontown units.

Hmlet and Habyt boast 8,000 units and gain global presence post-merger.

Giselle Makarachvili, CEO of Hmlet, said the Australian exit was largely driven by the prolonged closure of borders (see next story).

Brazen or not, the co-living space is set to expand further post-lockdown. JLL’s Hotels & Hospitality Group reported that Singapore, one of the first Asian countries to lift most travel restrictions, bounced back the quickest with transaction volumes approaching US$900 million in 1H2022. Most active was the mid-market space where investors identified opportunities to convert properties into a co-living product to boost performance, JLL said.

In diverse company

Aside from pure co-living players, serviced residences giant Ascott wants a hand in the next-gen product too. Ascott has eight Lyf properties in operation and 10 under development, four of which will open this year. The 18 Lyf properties represent 3,400 units in nine countries.

Ascott is targeting to have 150 Lyf properties with 30,000 units by 2030. Scale matters for operational effectiveness to drive better margins, said Kevin Goh, CEO for lodging,

CapitaLand Investment, in an interview.

“In addition to growing the Lyf brand via management contracts, we also see attractive opportunities for our private funds and our hospitality trust, Ascott Residence Trust, to deploy more investments into this product class,” he said.

Global hotel chain Accor also wants to play, fielding its co-living concept, Jo & Joe. In the game too is Singapore-listed Katrina Group, whose subsidiary ST Hospitality (formerly Straits Organization) operates four co-living properties in the city, branded ST Signature.

Then there is a string of small independent players. There are at least 10 in Singapore alone, such as Colliwoo, Hei Homes, Cove and Figment.

“I think it’s natural for serviced apartment players to try and maximise yield by generating some shorter stay income, and likewise for hotel operators to tap the more reliable income and certainty offered by longer stay products. So, we should expect to see both sides reaching into each other’s pocket,” said Robert Williams, head of hotels & hospitality Asia Pacific, Watson Farley & Williams.

“Ultimately it’s all lodging, and it is about capital that likes the space and operators plus brands that can truly demonstrate performance.”

The question is whether small players can withstand an onslaught from larger players in future.

“Niche players play a part in pioneering trends. But sooner or later it’s a matter of eat or be eaten,” said Bill Barnett, managing director, C9 Hotelworks, Thailand.

Jackpot

Co-living, as its name suggests, is all about staying in the same place and making new connections at shared communal facilities in a property. It hits a sweet spot with the next-gen and budget travellers, and a jackpot with Covid-19, which has fuelled trends such as work-from-anywhere and fewer trips but longer stays.

Co-living’s appeal to travellers also hinges on it being anything but cookie-cutter. No two co-living concepts, designs or spaces are alike, but all tend to be trendy and more affordable than a hotel room or serviced apartment. Most are high-tech with check-in/out and distribution (direct or via OTAs), and try to connect guests with one another and to local communities.

ST Signature, for instance, has 24-hour hosts to guide guests on where to find the best chicken rice and other destination insider tips.

The rate for the lowest category unit at ST Signature is from S$80 (US$58) a night, said Katrina Group’s COO of accommodation business, Andreas Lorenz.

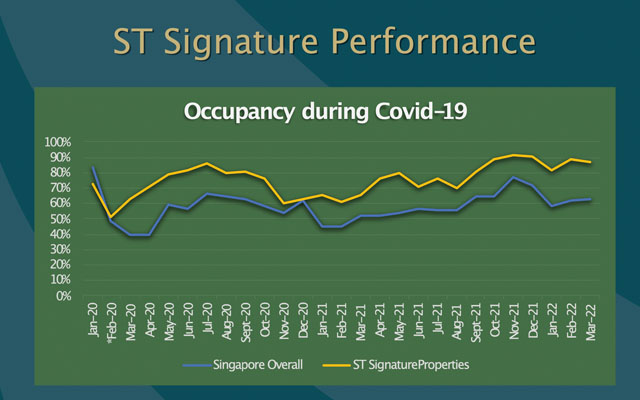

During Covid-19, ST Signature properties outperformed the market in occupancies, he said (see chart).

“The market has been on the rebound since Singapore lifted restrictions (late last year). Millennials haven’t travelled for two years due to Covid-19 and we’re seeing demand returning from the neighbouring countries and Europe,” said Lorenz.

Bulk of the market

According to a McKinsey report, millennials and Gen-Zs will form half of consumers in Asia-Pacific by 2025, surely a factor that puts co-living development in the minds of investors.

As well, in an era of labour shortage, co-living properties, like serviced apartments, are “low maintenance” compared with traditional hotels. Fewer transient guests check-in and out, and they tend to take better care of their home-away-from-home, Goh said.

Despite its potential, sexiness and cost-effectiveness, lodging investment consultants and hospitality CEOs doubt co-living would challenge the dominance of serviced apartments.

Said Robert Hecker, managing director Pacific Asia, Horwath: “It’s a reaction to perceived opportunities in the younger generation market or emerging demand segments (such as longer stays and work-from-anywhere). There’s nothing particularly more favourable about co-living than serviced apartments in profitability and returns.

“Perhaps the per square foot revenue is better in a three-bedroom co-living apartment than a three-bedroom in a traditional serviced apartment (occupied by one family), but I don’t see the cost structure being any different. Or perhaps the need for slightly larger common areas in a co-living situation ultimately spreads out the revenue so there’s no difference in revenue per square foot.

“I think co-living has its limits, so it may outpace for a bit, but ultimately serviced apartments serve a perennial need/demand.” Arthur Kiong, CEO of Far East Hospitality, said he is not seeing co-living as a more favourable investment than serviced residences.

“Yes, co-living is very popular and something we are also looking into. However, we are careful if this is just a passing trend or it will endure. And if it does, what the long-term market expectation with regards to product, services and technology, is” said Kiong.

“My mantra has always been, what sounds good may not actually be sound. So, we are still watching this space with an open mind.”

Co-living operators beg to differ, of course.

Said Hmlet’s Makarachvili: “We are of the view that co-living or what we call ‘flexible living’ at Hmlet, whether it resides in serviced apartments or residential buildings, will continue to gain traction as a new generation of renters come of age and enter the market.

“Ironically, as we emerge from lockdowns and Covid-19, we have never been more connected online via Zoom and other social media platforms, yet we have never felt more alone. This generation of consumers are tired of isolated and antiquated lodging products. There is increasing demand for the option of a seamless housing solution that also offers a sense of belonging and community. Flexible living opens a new way of housing and lifestyle for all generations – from students, working professionals to families to seniors.”