The latest Mastercard-CrescentRating Global Muslim Travel Index (GMTI), an annual study on the value and evolution of the Muslim travel market, has underscored continued growth in both travel volume and spend potential of the segment.

Unveiled at the fifth Halal in Travel Global Summit 2025 on June 12, which was conducted in-person in Singapore and online, the study stated that international Muslim arrivals reached 176 million in 2024 – up 25 per cent from 2023 and 10 per cent over 2019 levels – and are projected to grow to 245 million by 2030.

By 2030, total travel spending by this segment is expected to reach US$230 billion, highlighting the growing influence and economic potential of Muslim travellers.

It stated that with a growing global Muslim population, projected to reach 2.54 billion by 2035, this demographic segment will be come a crucial tourism source market for many destinations.

The GMTI 2025 study noted a significant evolution of the modern Muslim traveller’s profile and purpose, where there is a clear shift towards more independent and conscious journeys, evidenced by the rise of solo and female travellers seeking empowerment, safety, and autonomy.

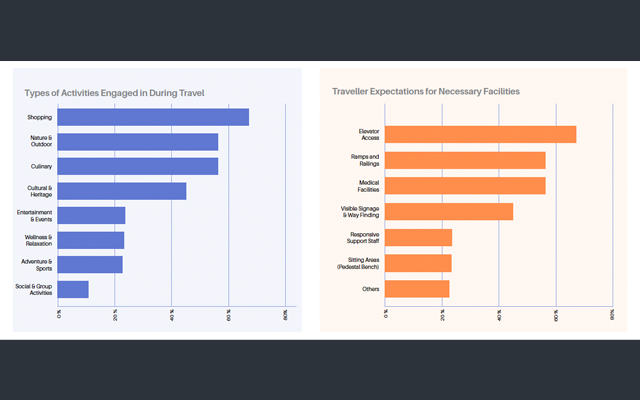

At the same time, travel motivations are diversifying beyond leisure to include purpose-led experiences such as regenerative tourism that restores local ecosystems, digital detox retreats that align with faith values of mindfulness, and sports tourism adapted for family and faith needs. This signals a demand for more personalised, inclusive, and meaningful travel experiences that cater to a broader range of abilities and interests, prompting destinations to offer more than just standard holiday packages.

The study also pointed to a need for faith-related awareness to be integrated into the industry’s use of robots and/or humanoids in streamlining operations, the use of smart apps to engage Muslim tourists, greater attention to accessible tourism and blending inclusive design with faith-specific needs, and stronger consideration for female Muslim travellers.

In sharing key findings of GMTI 2025, Fazal Bahardeen, founder of Crescentrating, highlighted the need to better understand and cater to active senior travellers, especially as “global birth rates are plummeting and lifespans are extending”.

“That has a huge impact on tourism; accessible tourism is going to be a lot more important,” he said, adding that the GMTI had, therefore, introduced accessible travel asset metrics and a basic framework on building accessible travel destinations last year.

This year, the study has taken a step further with increased focus on understanding active seniors, who will be “one of your most important segments going forward, because of the (population) and their spending power”, he said.

GMTI 2025 noted that senior travel is valued at 15 per cent of the global travel market, with value projected to reach US$2.63 trillion by 2030. This segment aged 60 years and up also allocates more than 50 per cent of their discretionary spending on leisure and travel.

With the flexibility of travel during off-seasons and the tendency to embark on longer, more relaxed journeys, this segment offers high-value opportunities for travel industry stakeholders aiming to tap into a resilient and expanding market.

While the outlook for Muslim travel is rosy, Fazal tempered expectations with warnings of “disruptive forces” – unpredictable geopolitical and economic conditions that would impact visitor flows; AI’s threat to job security and basic income, which could impact people’s ability to spend on travel; and growing anti-Muslim rhetoric, where even the slightest perception of lacking welcome would erode travel confidence.

Meanwhile, as with every GMTI, the study also ranks top performing destinations in the Muslim travel market.

Among Organisation of Islamic Cooperation (OIC) destinations, Malaysia retains the top spot, followed by Turkiye, Saudi Arabia and the UAE sharing the second spot. Indonesia takes fifth position.

Among non-OIC destinations, Singapore is top, followed by the UK, Hong Kong and Taiwan. Thailand (fifth) and the Philippines (eighth) are steadily emerging as rising Muslim-friendly destinations in South-east Asia, where investments in infrastructure and experiences for Muslim travellers are being made, stated Umair Hameed, vice president of consumer products & solutions for Southeast Asia at Mastercard.

GMTI 2025 marks the 11th year of collaboration between Mastercard and CrescentRating, and the 10th year of jointly publishing the annual study.

The full report can be downloaded for free here.