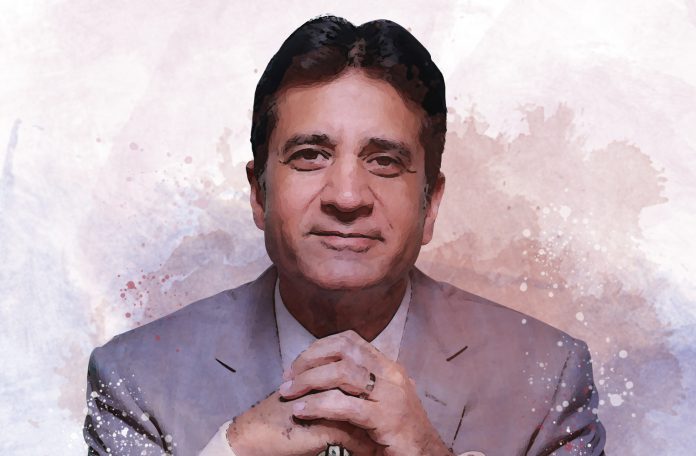

With a strategic expansion plan, a growing network of offices nationwide, and a deep understanding of shifting travel trends, Brightsun Travel aims to replicate its global success in India, shares managing director Deepak Nangla

Can you talk about recent developments in your travel agency?

Can you talk about recent developments in your travel agency?

Brightsun Travel is entering a milestone year as we will be celebrating 40 years of operations in the UK market next year. We initially launched our India operations in 2006 to support business from the UK, but over time, the potential in India itself has become too significant to ignore. Our UK business is currently valued at around US$500 million and our goal now is to replicate that success in India but on a much faster timeline.

India is central to our expansion strategy because of its growing travel population. So, we are not only increasing manpower at our existing Gurgaon base, but we have also opened satellite offices in cities like Mumbai, Chennai, Kolkata, Hyderabad and Amritsar to get closer to the market and understand regional preferences.

What’s truly fascinating is just how diverse India is. We are learning every day. Our aim is to convert these satellite locations into full-fledged offices, where customers can walk in and interact with our teams. Ideally, we would like to create seamless experiences such as connecting a traveller in Ahmedabad with our team in the UK to plan a customised Scottish holiday.

Beyond India, we have also established new offices in Ireland and most recently in the UAE, which opened on March 1. Having a physical presence in the Middle East is strategic, especially with tourism booming in the UAE and growing interest in destinations like Saudi Arabia.

How do you plan to drive your business in India?

Brightsun Travel has three arms or three verticals of getting in business. We have our B2B arm, along with a holidays and flight division that serves customers through tele-sales, and an online division for digital bookings and services. Each vertical has dedicated teams.

Additionally, we have what we call our SME and Concierge division, which targets corporate clients. A recent highlight is our partnership with HCL in India – a major win that showcases the robustness of our systems. To meet the expectations of companies with tens of thousands of employees, we must ensure our systems can effectively handle their queries and requirements.

What kind of travel trends are you currently noticing from the Indian market?

When we first focused on tourism in India around 2021, the domestic market was booming. We built strong local networks in different places like Mysore, Tirupati and Amritsar – but post-lockdown, outbound travel has surged. With new international routes and competitive airfares – for example, it is sometimes cheaper to fly to Vietnam than from Delhi to Mumbai – more Indians are exploring global destinations. The young Indian traveller is keen on engaging in diverse tourism experiences, from religious tourism to eco and sustainable travel. Our focus is to align with these evolving preferences and help travellers find holidays that truly resonate with their interests.

The inbound tourism market in India has been slow to recover post-lockdown. How do you see the demand for India in the UK, where you have a strong presence?

To be frank, the issue isn’t with the Indian government per se, but with the lack of a strong global tourism voice for India. Compared to countries like the UAE which expects to receive 24.5 million visitors in 2025, India’s inbound numbers are relatively low despite its rich culture and history. In fact, when you are visiting India, it is like seeing six or seven different countries. India has a lot to offer but I think the country has lost its share of voice in the global market. Currently, tourism promotion is managed by the Indian High Commission in the UK, which has its limitations. Such diplomatic missions have their own challenges and protocols. So, things like these need to change if India expects to grow its share in the global tourism market.

Indian outbound tourism, however, is booming. Which destinations do you think will be most popular in 2025?

The biggest hurdle remains the visa process. Destinations with easier or visa-free access, such as Thailand, Vietnam, and the Maldives, are seeing strong interest, while Turkey is also experiencing growth. Mini-breaks of four to five days are becoming popular due to India’s demanding work culture, leading last-minute travellers to favour visa-friendly destinations. Countries like Nepal and Singapore are also doing well. Interestingly, Japan is now gaining traction, attracting a large number of customers. Japan, to me, would not typically be an Indian-centric holiday, simply because it is an expensive place to visit. One week in Japan is equivalent to almost one and a half weeks in Europe, but the Indian traveller wants to explore new things. And, because there are fewer visa implications, they are choosing these destinations more and more.

How do you see the domestic tourism market evolving in India?

The domestic market will be shaped by hotel infrastructure. Airline capacity is increasing with new airports, but more hotel rooms are needed – especially in the three- and four-star segments, which account for 75 to 80 per cent of domestic demand.

Cities like Bangalore, Jaipur and Delhi are adding new room inventory, which will naturally boost tourism there. Seasonal hotspots like Kashmir, Leh and Kerala will always remain popular. Destinations like Jaipur, Jodhpur and Udaipur are seeing growth in the number of high-end weddings which often turn into extended holidays. Wildlife tourism, especially in places like Ranthambore, is also trending.

Do you see the limited number of hotel rooms in India as a challenge?

Absolutely. It is one of the biggest challenges we face. To put it in perspective, the UAE has more hotel rooms than all five major metros in the UK combined. India needs to scale up its hotel capacity drastically. However, it’s not just about the number of rooms – the type of hotels being built is equally important. The demand lies in the three- and four-star accommodation, and that’s where development should focus to effectively meet the growing tourism demand.