A new study conducted by the Luxury Group by Marriott International has found that high-net-worth (HNW) travellers in Asia-Pacific are prioritising well-being, immersive experiences, emotional value, and intentional design over volume and extravagance.

The Intentional Traveler report, which surveyed 1,750 affluent travellers from Australia, Singapore, India, Indonesia, South Korea, Japan, and Thailand over a period from March 14 to April 17, 2025, picked up a luxury travel mindset that is marked by deeper cultural engagement, increased precision in itinerary planning, and rising expectations from brands and experiences.

Demand for personalisation has surged, with 93% of respondents expecting every detail of their trip to be tailored, up from 83% in 2024.

Planning is also prioritised, where 62% of respondents say they plan every detail of their trip in advance, up from 53% the year before. Bookings for long trips are made two to three months ahead, while short trips are locked in one or two months in advance. Solo travellers are the most methodical, with 73% booking well in advance.

In line with this shift, travellers are increasingly doing their own research, placing more trust in official and trusted sources like hotel websites, and less in personal recommendations, which dropped from 34% to 26% year-on-year. Notably, one in five travellers now turn to AI to help craft their luxury travel plans.

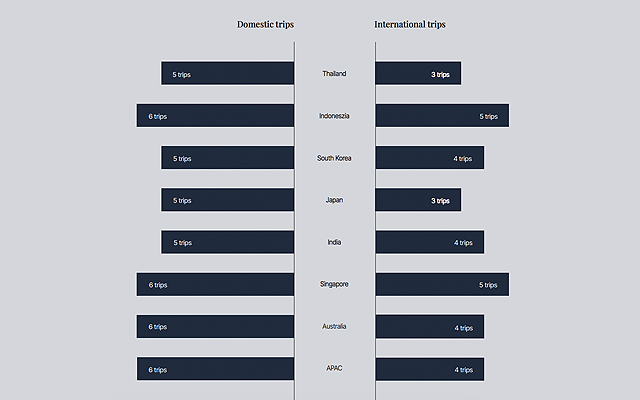

Overall, travel has declined year-on-year, with fewer trips planned and shorter international stays. The average traveller is now planning six domestic and four international leisure trips in the next 12 months – two fewer international trips than in 2024.

While domestic sojourns have increased from three to four nights, long international stays have dropped, from 2.5 weeks in 2024 to just 1.5 weeks in 2025.

Despite the pullback in quantity, variety in travel types remains strong. Beach holidays remain the most popular type of vacation, holding steady at 37%. Cruises have seen a notable resurgence, climbing 11 percentage points to secure a spot among the top five travel choices. Wellness and spa getaways have also gained momentum, rising to 26% from just 19% in 2024. Travel for religious events is on the rise as well, now accounting for 17% of trips. Meanwhile, safaris continue to capture the imagination of adventurers, with 30% of travellers planning a nature-focused journey.

The longest domestic holidays are now being driven by a desire for personal growth, with top themes including medical tourism, religious events, and educational travel. Internationally, the longest trips are linked to cultural and spiritual enrichment as well as relaxation, with religious events, cultural festivals, and beach holidays topping the list.

Changing dynamics

The report also notes that travel this year is being reshaped not just by where people go – but by who they go with and why they travel. Traditional groupings like family vacations continue to hold strong, but new dynamics are emerging, reflecting evolving lifestyles, priorities, and values among HNW travellers.

It identifies the Guardian Trailsetters segment – solo parents travelling with children. This group has grown from 15% to 24% in just one year, and is attracted to itineraries that offer opportunities to take their children out of their comfort zone, such as religious events (41%), educational trips (38%), and safaris or extreme adventures (both at 35%).

During these trips, HNW solo parents diverge from their usual habits when it comes to travel arrangements, seeking alternative accommodation including friends’ homes (37%), home stays (37%), and Airbnb (34%) over luxury hotels (27%).

Another notable segment is Impact Explorers – the Gen Z segment that pays attention to seamless tech integration, sustainability, experiential depth, and authenticity in their travel plans. Australia, Sri Lanka, and Thailand are highly favoured by this group, reflecting a craving for nature, culture, and adventure. Gen Z travellers are more motivated by meaningful, active pursuits: 47% prioritise being close to nature; 45% are eager to see wildlife, and 43% are drawn to active sporting holidays.

Solo travel is embraced by 31% as a path to independence and self-discovery, while small group trips (under five people) remain their preferred format.

The third traveller grouping is the Venture Travelist, a breed of traveller who blends business acumen with wanderlust. The report notes a rapid expansion of this segment – 86% of respondents now say they research business or investment opportunities while abroad, up from 69% last year. This trend is particularly strong in South-east Asia, where cross-border connectivity and entrepreneurial energy create fertile ground for new ventures.

At the same time, 78% of respondents say they combine leisure with business when travelling internationally, up from 71% in 2024. This style of travel is even more pronounced in domestic trips, with 86% of travellers mixing business and leisure within their home destinations, often using work commitments as a springboard for personal travel or family time.

Wellness investment

Wellness has become central to the luxury hotel experience, with 90% of respondents citing wellness offerings as a key factor in their booking decisions, up from 80% in 2024. In fact, 76% say they are likely to book a treatment during their stay.

Asia is the top destination of choice, with 67% of wellness-minded travellers planning their trips within the region. 75% are also booking their retreats three to 12 month ahead.

Luxury travellers seek wellness as a multidimensional experience – one that includes physical vitality, emotional balance, and mental enrichment.

According to the report, the modern wellness traveller from Asia-Pacific is 34 years old, gender-diverse, and likely to be in a relationship or married. Wellness travel is increasingly becoming a shared experience, with 55% of respondents planning to take a wellness retreat with immediate family, and 54% intending to do so with a significant other.

Back to nature

Luxury travellers in 2025 are increasingly prioritising meaningful connection to the outdoors. From vineyard retreats to remote safaris, nature-driven travel is evolving from a niche interest into a core pillar of the luxury experience. 28% of respondents are planning such trips this year, up from just 19% in 2024.

The appetite for natural beauty extends to safari travel, with 30% of respondents planning a wildlife-focused adventure.

Nature-based travellers are planners at heart, with most booking long trips two to six months in advance – and some as far as nine to 12 months out.

Family remains a key unit of travel, with 21-22% preferring to explore nature with immediate family.

Australia, Japan, China, and Singapore are favoured, drawing affluent nature lovers with a blend of natural beauty, safety, and refined hospitality.

Respondents who prioritise nature and wildlife often look for destinations that offer vegetarian or vegan menus (49%), healthy food options (48%), and eco-conscious practices (47%). For them, the luxury of nature is not just in the view, but in the values behind the experience.

Higher spend, higher demand

The choices of today’s affluent travellers reflect a new kind of luxury: one driven by authenticity, excellence, and a desire to make every moment – and every dollar – count.

72% plan to spend more on travel over the next 12 months, with the strongest intention detected in Australia (85%), Indonesia (81%), and Singapore (80%).

Notably, India, which previously topped the list, has seen a shift – now at 72%, indicating a more measured approach this year. Japan remains more cautious: 45% of respondents plan to spend the same or less, with one in five actively reducing their travel budgets.

Not only are affluent travellers prioritising luxury hotel brands over secluded villas or ultra-private retreats, they are also putting family first while on trips. 47% are most willing to invest in premium travel experiences when travelling with their families, outpacing all other group types.

They are also increasingly drawn to full-board, all-inclusive packages that offer convenience, consistency, and a sense of ease – especially when travelling with loved ones. Interest in all-inclusive options is strongest from Indonesia (66%) and Australia (53%), where travellers appreciate the predictability and comprehensive service such packages offer.

Return to familiarity

After several years of destination experimentation, the pendulum is swinging back towards the comfort, connection, and emotional resonance of familiar locales.

An overwhelming 93% of HNW travellers in the region say they prefer to return to beloved destinations, and 89% agree they are more likely to revisit places where they feel a genuine sense of connection.

The Intentional Traveler report notes that the return to familiarity marks a maturing of the luxury travel mindset. It is no longer just about where one can go, but where one wants to return – places that feel emotionally rewarding, culturally enriching, and personally significant. For brands and destinations, this means a greater emphasis on personalisation, continuity of service, and relationship-building with returning guests.

Although there is a return to familiar destinations, “new” options have also entered the top 10 chart. Bangladesh, New Zealand, and Cambodia are now among the top 10 destinations to visit in 2025.

High-energy days, soulful nights

A new travel rhythm is emerging – affluent travellers are filling their days with excitement and exploration, while reserving their evenings for rest, reflection, and refined experiences.

The number of travellers who say they pack their days with activities has surged from 48% to 61% year-on-year. The desire to bring home memories and experiences has also risen, from 54% to 64%, underscoring a growing emotional investment in travel.

Adventure is at the heart of this shift. A remarkable 80% of travellers now engage in high-adrenaline or sporting pursuits, up from 72%, while 87% are seeking out high-profile events, from international festivals to major sporting spectacles – up from 72% in 2024.

Deeper connections matter too: 42% want new connections while travelling, including shopping locally (46%), participating in meaningful cultural activities (42%), and exploring historical narratives (36%).

Nature also plays a central role: 92% want to be close to nature, 86% plan to see wildlife, and 49% prioritise being in breath-taking locations.

When evening arrives, more travellers now prefer to spend their time in their hotels – up from 19% last year to 28% in 2025.

Epicurean escapes

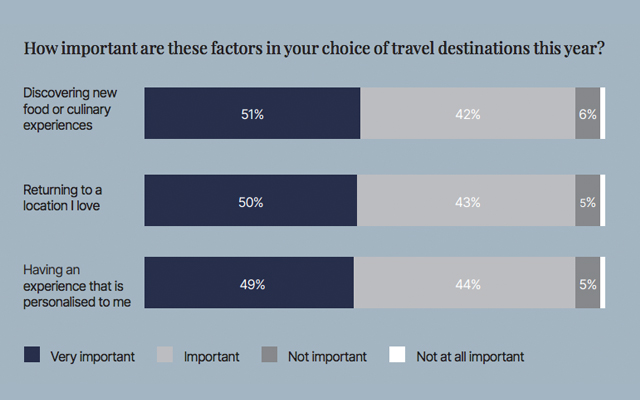

Gastronomy is unshaken as the leading travel motivation. HNW travellers are seeking immersive, story-driven culinary experiences that elevate travel into art.

93% of respondents want to discover new food or culinary experiences, with 51% describing it as “very important”, a significant rise from 40% in 2024.

The same percentage (93%) want to visit a new restaurant they have heard about, highlighting the influence of reputation and digital word-of-mouth in shaping dining choices.

44% strongly agree that dining in award-winning restaurants defines the luxury experience, while 29% are willing to spend more on a top-ranked meal, even if it means adjusting other aspects of their trip.

Oriol Montal, regional vice president, luxury, Asia Pacific excluding China, Marriott International, told TTG Asia that with affluent travellers cutting down on travel frequency, but intending to spend more on purpose-driven trips that truly count, Marriott International’s hotels will have a key role to play in helping their guests “get the most out of their trip through pre-arrival planning and customised arrangements”.