Indonesian president Prabowo Subianto has confirmed that the increased value-added tax (VAT) from 11 per cent to 12 per cent, effective from January 1, applies only to luxury goods and services.

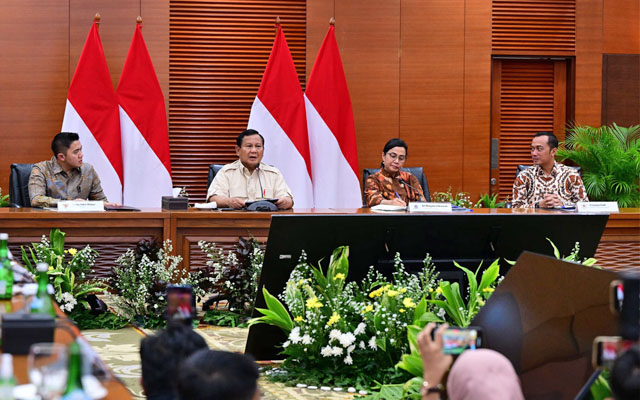

Speaking at a press conference in Jakarta on New Year’s Eve, Prabowo explained that the VAT increment would only be be imposed on luxury goods (classified under the Sales Tax on Luxury Goods or StoLG category) and services, such as private jets, cruise ships, yachts, and luxurious houses.

He further clarified that VAT on non-StoLG goods and services would remain unchanged. Items that have been subject to 11 per cent VAT since 2022 will not be affected, while basic goods and services, which have been exempt from VAT, will continue to benefit from these tax exemptions.

Sri Mulyani Indrawati, Indonesia’s minister of finance, also explained: “Goods and services that have so far received VAT exemptions, such as staple foods, public transportation services, train tickets, ferry services, travel agency services, government and private medical health services, financial services, pension funds, and credit cards, will still receive zero per cent VAT.”

The government’s plan to raise the VAT from 11 per cent, which has been in place since 2022, to 12 per cent had previously raised concerns across various sectors, including the hospitality industry.

For example, the Indonesian Hotel and Restaurant Association (IHRA) had requested a review of the plan, arguing that a higher VAT would result in weaker earnings, particularly among hotels catering to lower- and middle-class consumer segments.

IHRA secretary general Maulana Yusran said: “Purchases of necessities are subject to VAT, and the VAT hike will increase operational costs. The impact could still be significant.”