The Ascott Limited has reported a 28 per cent year-on-year increase in fee-related earnings to S$331 million (US$245.7 million), up from S$258 million in financial year 2022, as well as the highest number of property openings with nearly 9,600 units turning operational in the same year. The achievement is largely due to the “flexibility and agility” of Ascott lodging properties’ flex-hybrid business model, which performed during “both challenging and good times”, thus attracting keen owners.

In an interview with TTG Asia, Ascott’s chief commercial officer, Bee Leng Tan, elaborated: “We did not have to close a lot of our properties (during Covid) because of our apartment-style product’s flex-hybrid business model. This business model…got us a lot of validation from third-party owners who saw how well it can perform in both challenging and good times. As a result, we had better signings during the pandemic and continue to see record signings, which led to record openings.”

Ascott defines the flex-hybrid business model as one that allows the company to be flexible with product and room mix, enabling agility to pivot operations to suit the needs of the market and optimise occupancy. With a hotel-in-residence model that supports adaptability, the model also allows Ascott to cater for varying lengths of stays, from short to extended periods, and for different guest profiles, from solo travellers to groups, while providing elevated services, facilities and amenities similar to that of a hotel.

With the appeal of such a business model, the company also attracted intense conversion signings.

Tan said that with conversions, there was no need to build a property from scratch, allowing owners to convert their existing property to an Ascott brand and take it to market sometimes as quickly as within a month.

She shared that of all the Ascott lodging brands, Citadines is the most powerful in the “conversion play”.

“Citadines is now one of our fastest growing brands. It is conversion-friendly, given that it carries very distinct brand signatures that are easier to (deploy) in both new and existing properties,” said Tan.

One of Citadines’ brand experiences is the For the love of coffee programme, which conveys the local coffee culture through a cup of local brew served on property.

“Citadines is an urban city brand and is present in all the key gateway cities. We believe that every city has its own unique coffee culture, and our guests – many of whom are business travellers who cannot get through their day without coffee – can experience city living through the local brew,” she said.

“The owner does not have to tear down this wall and alter that space just to align with our brand standards.”

There are now more than 200 Citadines properties globally, both operating and in the pipeline. Fifty-four of these – or more than a quarter of the Citadines portfolio – are in China. Within South-east Asia, Citadines properties number the most in the Philippines, with 18 in operation and in the pipeline.

Tan shared that The Collection brands – The Unlimited Collection and The Crest Collection – are also ideal for conversions. They are best suited for existing properties that are “very premium, luxurious and unique”, and allow “owners with boutique properties to come to us and benefit immediately from our flex-hybrid business model”.

The Crest Collection portfolio, once concentrated in France, has expanded into Asia. It now comprises The Grand Mansion Menteng in Jakarta, The Robertson House in Singapore, and The George Penang in Malaysia.

As these were signed and opened within months, The Crest Collection “gained a lot of attention from owners”. The portfolio will soon be joined by fresh conversions in London, Paris and Bucharest.

Looking ahead, Tan sees opportunities in altering the Ascott playbook for a stronger presence in tourist destinations.

“Traditionally, we have been more apartment-type and more long-stay focused; we are the market leader in this very corporate-focused segment. Now, we are seeking opportunities to expand our portfolio in tourist destinations, so as to play in the wider hotel space,” she said.

The company has already made its move, with the new Oakwood Suites Chongli in China setting a prime example.

She explained: “The location is popular with business travellers, but it is also known as one of the host cities of the Beijing 2022 Olympic Winter Games and has beautiful snow mountains. We know that business travellers would likely extend for business, or be joined by their family. In this case, Oakwood is an ideal brand due to its blended travel positioning as well as its strong F&B offering.”

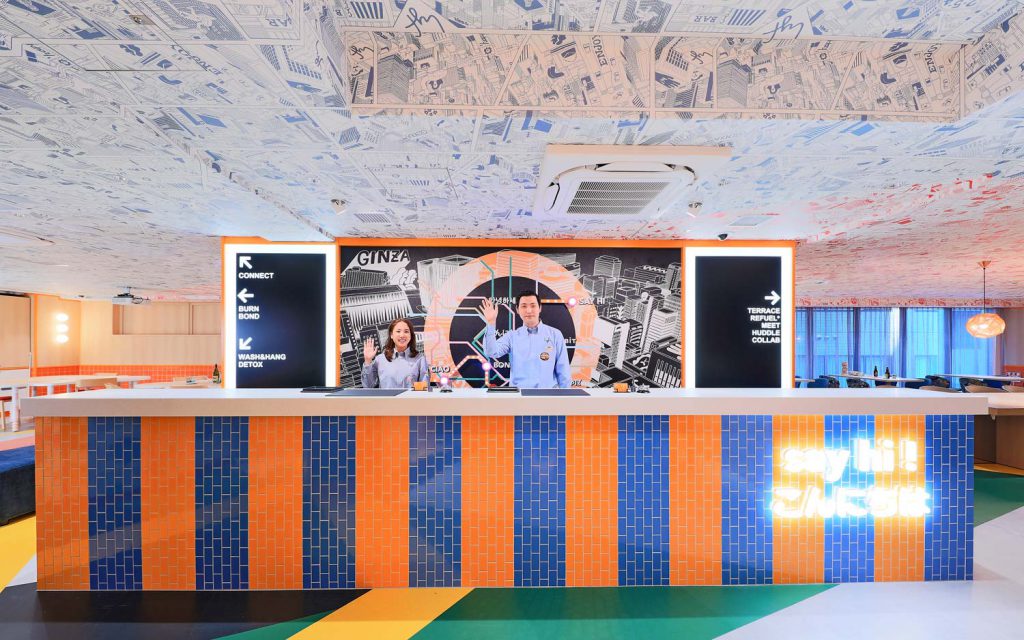

lyf, a brand that Ascott had designed and created itself, is also thriving in tourist destinations. lyf Ginza Tokyo opened November 2023, marking the brand’s entry into the Japanese capital; a second property will soon launch in Shibuya. Beyond Japan, lyf is also opening in Bondi Junction, Sydney; Gambetta in Paris; Ostend in Frankfurt; Canggu in Bali; Penang and Kuala Lumpur in Malaysia; among many others.

Other Ascott brands could work in tourist destinations too, and the conversion team would assess location, hardware, and potential clientele before identifying the relevant brand, according to Tan.

As Ascott charts its journey into tourist destinations, Tan said a large team of “hunters” – business development personnel – is “going out to make sure everybody knows Ascott is here for the party”.

“We are telling owners that they can bring their hotel or resort properties to Ascott, not just their apartment-type real estate and that Ascott is prepared to manage a variety of properties for them. We have the right products and brands for any travel intention, be it business, leisure, wellness or medical,” she remarked.

In an earlier press statement, Kevin Goh, CEO for Ascott and CLI Lodging said 2023’s stellar performance has put the company on track to achieving its target of more than S$500 million in fee earnings by 2028.